Calculate hourly wage by minutes

You are also entitled to pay for rest and meal periods. For the hours enter 4 For the minutes enter 30 With that.

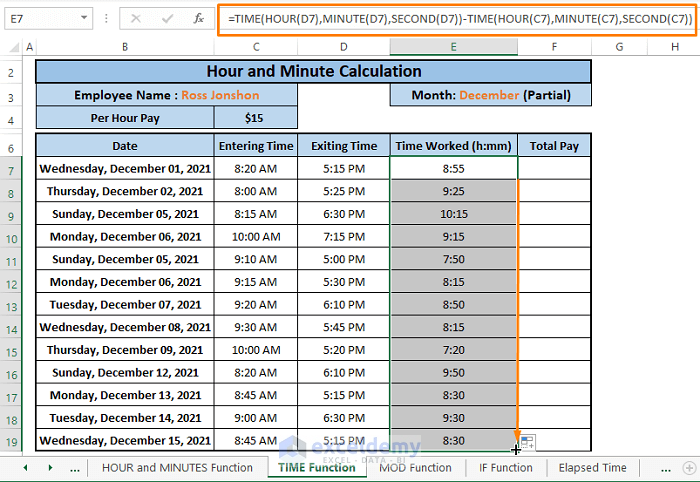

How To Calculate Hours And Minutes For Payroll Excel 7 Easy Ways

213 30 6390.

. The prevailing wage for each classification includes an hourly Base Rate and an hourly Fringe Rate and it is the combination of these two amounts that must be paid to the worker. Employees dont work perfect hours. Includes example calculations.

OASI DI OASDI Amount in billions 31 24 56 Percent of Benefit Payments 03 17 05 5Part D premiums vary by plan. If you enter your annual wage then the calculator will assume you work 250 days a year 50 weeks of 5 days a week. Calculating the minimum wage.

The manager needs to accurately calculate the payable amounts for each hourly employee either by rounding off time or using actual hours. Indicate whether or not you want to create a side-by-side comparison or calculate the purchase and ownership costs of a single vehicle. Form ETA-9142C Appendix C - AttorneyAgentEmployer Declarations.

So if your regular hourly rate is 800 and you work 50 hours during a given workweek you will end up receiving 12000 in overtime wages 800 x 15 1200 x 10 OT hours 12000 for that. In the Distance in miles field enter the 200. Before sharing sensitive information make sure youre on a federal government site.

Wage and salary costs averaged 2719 and accounted for 704 percent of employer costs. Federal government websites often end in gov or mil. 2018 2019 OASDI Administrative Expenses Excluding Treasury Administrative Costs FY 2020.

To convert an employees salary into an hourly rate simply divide the yearly salary by the number of work hours in a year. Online Application for Prevailing Wage Determination. Prevailing Wage PERM LCA H-2B ETA-9141.

See charts 1 and 2 and tables A and 1 Total employer compensation costs for private industry workers averaged 3861 per hour worked in March 2022. Standard Pay Rate Definitions for Enhanced Wage Records MULTIPLE PAY RATES - Use the average hourly pay rate for the quarter. The amounts shown in this column are added to the plans premium.

If another employee makes 20 per hour their overtime rate is 30 per hour 20 x 15. You traveled 200 miles in 4 hours and 30 minutes. Dont worry we wont send you spam.

Overtime is at least 15 times the employees regular hourly rate. For workers with more than one hourly rate or who have both hourly and piece rate pay calculate their regular hourly rate by totaling the weekly amount of pay and divide by the hours worked. For example if an employee worked 9 hours per day he or she would earn 8 hours at the regular rate of pay and 1 hour each day at a rate of 15 times the regular rate for the first five days.

You probably already know how much you make per hour. 1875 x 50 93750 Hourly overtime wages x Total overtime hours Working Hours as per Saudi Labor Law According to Saudi Arabia labour law a worker may not be asked to work more than eight hours a day if the employer uses the daily work basis or more than forty-eight hours a week if he uses the weekly work basis. Work out the hourly rate.

So lets say you need to make 5000month to live expect your business expenses to be. It typically takes 2 minutes or less to run payroll. It will take only 2 minutes to fill in.

SurePayroll offers all the following plus much more. You can then use this figure to make sure the rate of pay is at least the minimum wage. Calculate the total hours you work each year.

You can enter your annual salary hourly wage or monthly salary and the daily wage calculator will instantly calculator what you are earning on a daily basis. Access to our award-winning US-based customer service team. Calculate your OT rate and periodic or annual overtime wages plus discover how to double your OT rate all with this online overtime calculator.

Generally the prevailing wage rates for Oregon public works projects vary depending on 1 the type of work performed 2 the county in which the work is performed. FLSA SPECIAL LAW ENFORCEMENT EXEMPTION - If working 84 hours per pay period or 2184 hours annually before incurring overtime pay. For example you might make 15hour.

Minutes This is the number of minutes over the last number of hours. Piece-rate workers must be paid on the employers time which is based on their regular rate of pay or the minimum wage whichever is greater. Although the federal minimum wage has since been raised to 725 an hour the FICA tip credit will continue to be based on the old minimum wage of 515 an hour due to the Small Business and Work Opportunity Tax Act of 2007.

If you want the calculator to calculate how many hours you will need to allocate to working to cover the purchase and ownership costs enter your Real Hourly Wage. Base Annual Pay 2184 Hourly Pay to determine Nominal. Most nonexempt employees in California have a legal right to receive overtime wages when they work long hours1 The amount of overtime depends on the length of the employees shift and the number of days.

Form ETA-9142C Appendix B - Additional Worksite and Wage Information. Look at this example. To determine Sarahs weekly wages multiply her hourly wage by hours worked weekly.

This number is also commonly known as time-and-a-half So if one employee makes 10 per hour their overtime rate is 15 per hour 10 x 15. Rest periods are usually less than 20 minutes. Overtime wages are a type of increased payment that employees can earn when they work more than a certain number of hours in a workday or workweek.

Wage percentile 3139 at the 50th median wage percentile and 7858 at the 90th wage percentile. Find out your hourly wage. The standard overtime rate is 15 times the employees regular hourly wage.

If all of his vacation days and holidays are unpaid he should receive 35872 39520 less his hourly rate multiplied by the 8 hours from each of the 24 holiday and vacation days. Total Monthly Living Expenses L Total Monthly Business Expenses B Total Billable Hours Per Month H Total Taxes T Your Minimum Hourly Rate LH 1 T BH Example. The gov means its official.

How to calculate the average hourly rate and the number of hours worked over a specific period so that you pay the correct wage. For example in an 8 hour day one employee might work for 7 hours and 49 minutes while another employee works for 8 hours and 23 minutes. ETA-9141 Application for Prevailing Wage Determination.

You should receive pay for meal periods if you have to be available to. Its a challenge to manage employees calculate their hourly paychecks and process your payroll all while running a small business. If you dont want the download the free rate calculator above the math goes like this.

The employee is entitled to receive the same position or.

Excel Formula Basic Overtime Calculation Formula

How To Calculate Hours Worked Ontheclock

How To Calculate Hours Worked Ontheclock

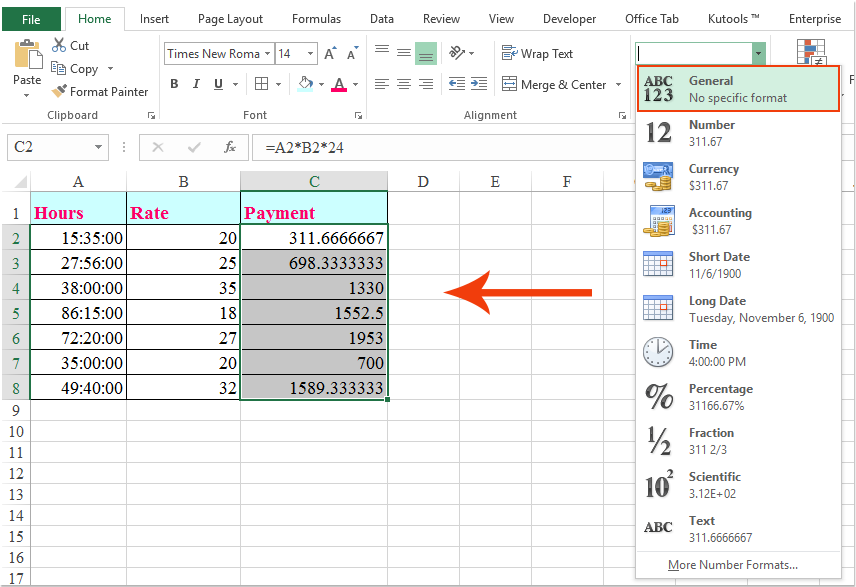

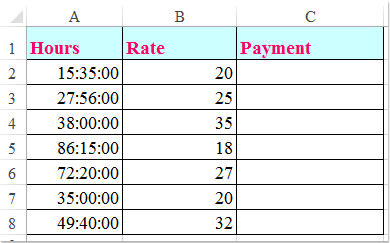

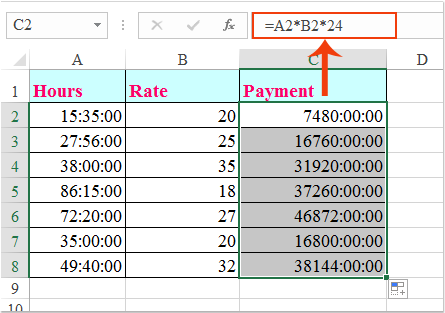

How To Multiply Hours And Minutes By An Hourly Rate In Excel

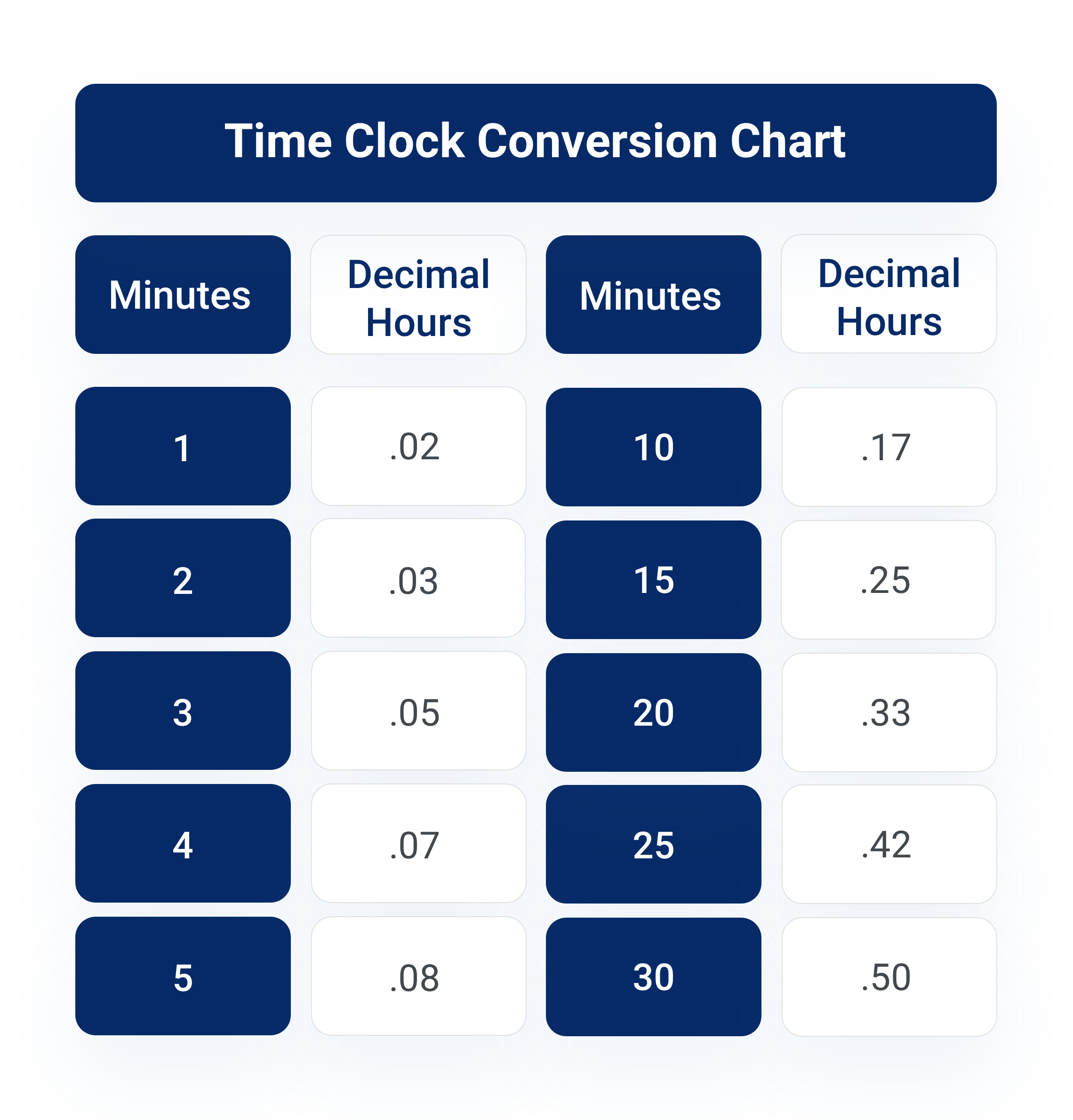

Time Clock Conversion Calculator For Payroll Hourly Inc

How To Multiply Hours And Minutes By An Hourly Rate In Excel

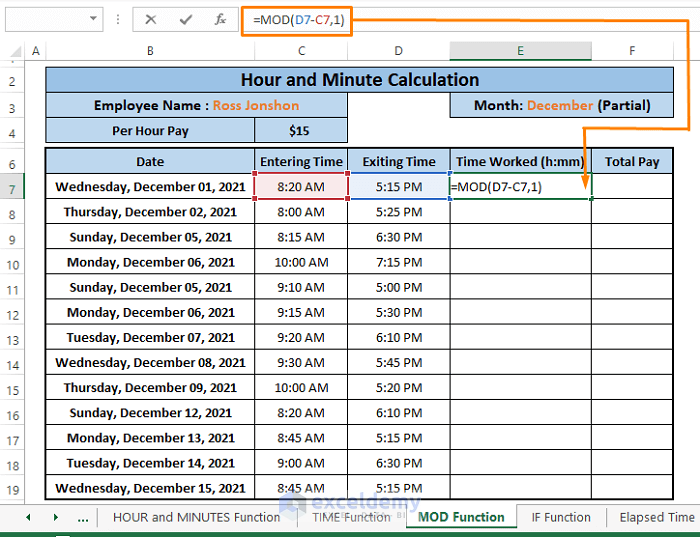

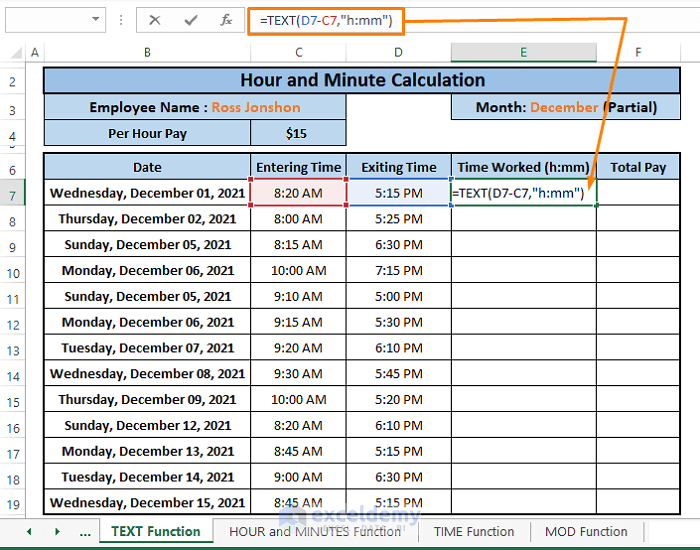

How To Calculate Hours And Minutes For Payroll Excel 7 Easy Ways

Time Clock Conversion Calculator For Payroll Hourly Inc

How To Calculate Hours And Minutes For Payroll Excel 7 Easy Ways

Hourly Payroll Calculator On Sale 56 Off Www Wtashows Com

Excel Formula Convert Time To Money Exceljet

3 Ways To Calculate Your Hourly Rate Wikihow

How To Multiply Hours And Minutes By An Hourly Rate In Excel

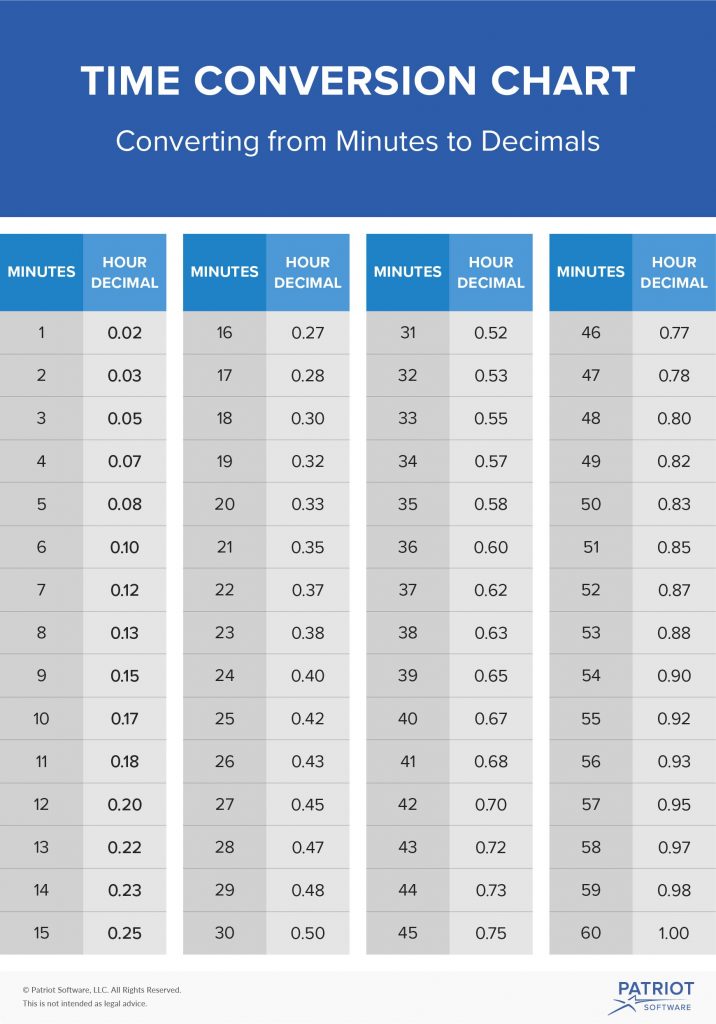

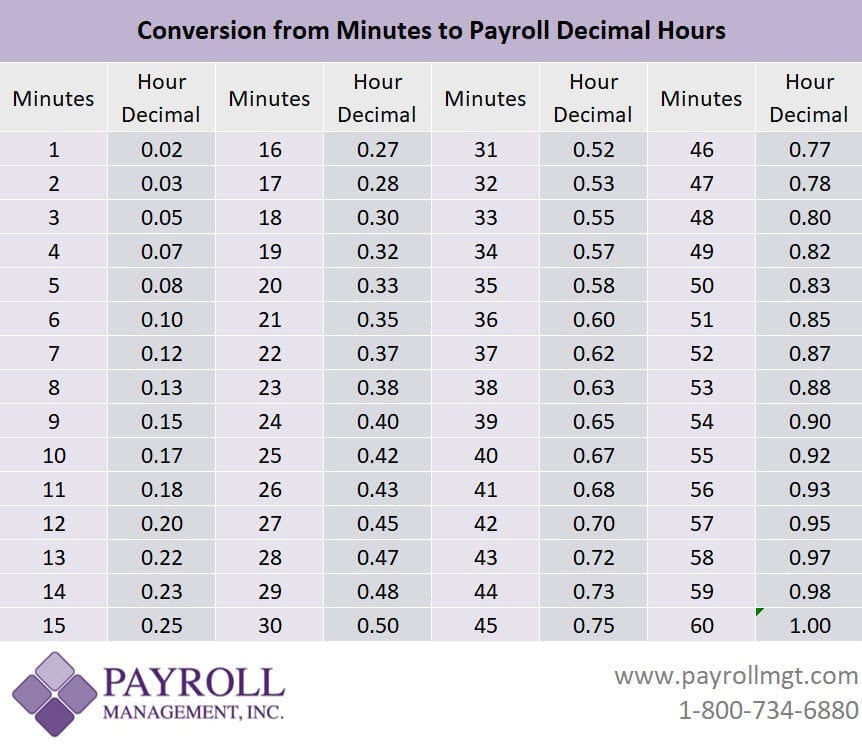

Minutes To Decimals Conversion Chart Payroll Management Inc

How To Calculate Payroll For Hourly Employees Sling

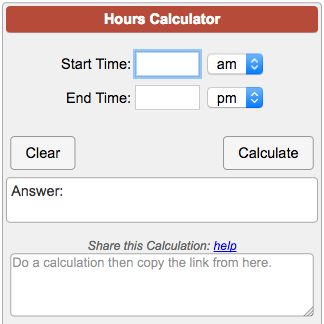

Time Calculator For Payroll Hot Sale 57 Off Www Ingeniovirtual Com

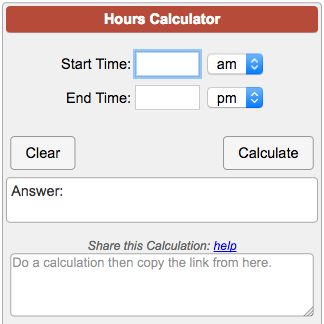

Hours Calculator